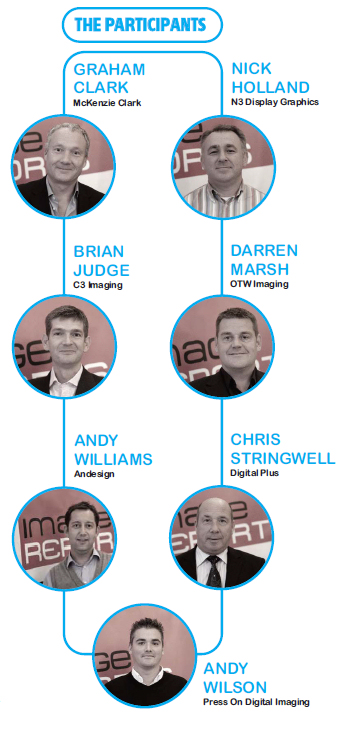

A cross-section of digital wide-format psps recently came together to discuss the findings of the Image Reports’ 2009 widthwise survey and to comment on the state of the UK market. Here’s what Graham Clark from McKenzie Clark, Nick Holland from N3 Display Graphics, Darren Marsh from OTW Imaging, Brian Judge from C3 Imaging, Andy Williams from Andesign, Chris Stringwell from Digital Plus and Andy Wilson from Press On Digital Imaging had to say...

Put seven printers together around a table with a remit to debate the state of trade and direction of the marketplace and you know you’re for a lively discussion and some eye opening comment. That’s exactly what the participants in this second annual Image Reports Round Table delivered. The panellists, chosen to represent a cross-section of the UK’s digital wide-format market, were asked to provide their thoughts on the back of key findings from the magazine’s 2009 Widthwise Report and as a precursor to the upcoming 2010 survey. On the broad issues there was a high level of agreement but don’t be led into thinking that meant everyone was of one accord! Here’s how the discussion panned out…

The growth of wide-format

Of those Widthwise survey respondents who said their workload was not totally wide-format 70% said they expected to grow their WF offering before spring 2011. Many other newcomers are entering the marketplace too, so is there room for all in an expanding wideformat marketplace?

“I think wide-format will expand next year and the year after that, and after that,” said Darren Marsh of OTW Imaging. “I don’t know anyone personally who has seen a real bad fall in this business in the last year and in this climate that’s a major plus. Digital wide-format is taking more of the screenprint market and there are many more opportunities opening up so the sector will continue to grow. The problem is, people who have been made redundant are buying a cheap printer and selling banners for £19.99. That’s really damaging to the market and shows they don’t really know the costs of running a proper set-up over time.”

This was a comment which struck a chord with most of the panel, but that led to a general consensus that companies need to be more creative in business and find more profitable niches.

“The marketplace is expanding and you’ve got to look to delivering something different,” voiced Chris Stringwell of Digital Plus. “Roller banners and A1 prints aren’t worth doing. We really capitalise on print-and-cut – and we see installation as a major part of any job.”

“I get a lot of architects with very specific questions and want to know about risk assessments etc. The little start-ups just couldn’t cope with that,” said Andy Wilson of Press On Digital Imaging, with Brian Judge of C3 Imaging adding: “Cut vinyl is a real growth area as we see it. A lot of those companies selling banners cheaply aren’t being creative with the kind of print they can do. We bring in more valeadded work by expanding on the brief and then going in and explaining what we can do.”

“The market is really now so diverse and the machines so versatile that you really should be able to go into any company and get business,” agreed Andy Williams of Andesign.

“The easiest thing to do is put the ink on paper, the more difficult part is producing other value-added services, such as data management,” enthused Graham McKenzie of McKenzie Clark. “A big threat is the amount of screen and litho printers coming into the market. You need to be able to offer customers something over and above what the others can and have the infrastructure in place to make sure you can handle customer relations effectively.”

It was generally agreed that the amount of customer hand-holding required was growing as added-value services entered the equation, but as Williams summed up: “Be a service provider not a printer and charge them [the customer] all the more for it.”

Encouragingly, not one of the participants thought wide-format had suffered in the current economic climate as much as other industries. Opportunities and threats At the time of the Widthwise survey of printers earlier this year, 88% of respondents said they expected the internet to bring them new business by spring 2011, so it was somewhat surprising to find the panel lukewarm about the potential from online business. “We’re happy to let the internet look after the low-end work,” said Stringwell, echoing the thoughts of the majority around the table.

“We’ve tried online ordering and it’s just not worth the hassle,” said Nick Holland of N3 Display Graphics.

“Web-to-print is just not our thing,” added Wilson. “All you do is compete on price online – we want to do something different,” stressed Marsh, a line taken by most of the panel.

But as McKenzie pointed out, it’s not all about direct sales. “The Web does offer a great opportunity because it’s a great marketing tool.” Perhaps it does too good a job! Wilson admitted that: “I leave old stuff up on our website on purpose. Print brokers fish websites and I don’t want everyone knowing too much about what I offer. We use a custom build MIS in-house with data that goes back ten years and we’d rather use that as the basis of our marketing activity.”

The response from the panellists on threats to business was overwhelming bad debt – and the lack of protection afforded small business. “Some of our worst payers are those who have been good customers but who are having cashflow problems themselves. No matter how well we try to manage that kind of client there’s not a lot we can do.”

Williams brought up a point that touched a nerve around the table: “We’re in the same position – and when do you say enough is enough?” So what about looking for new customers? As outlined above, the panel had already discussed various areas of potential growth, but what about export? Perhaps it had something to do with the sectors in which they predominantly operate or the fact that only two of the seven companies represented at the Round Table had a turnover of over £2m, but this was an area most seemed to have dismissed.

“The logistics make it more effort than it’s worth,” said Marsh, a comment that most – but not all – agreed with.

“I think there are opportunities for export but we need to set up better first,” argued Williams. The main proponent of the idea was McKenzie: “I think that in the UK we’re more responsive than other European printers – and at the moment we’re seen as cheap in Europe. We do a lot of work abroad for UK-based clients and if you get the logistics sorted there’s potential there.”

Market development

So do we do enough generally to develop markets for wide-format? In the Widthwise survey exhibitions graphics, POS/retail and general signage/banner work unsurprisingly came out as the biggest WF markets in the UK – the same were cited as having the strongest growth potential. But, ‘finding new markets’ came out top among printers asked to prioritise business development so do we do enough to ‘evangelise’ to about the possibilities of WF to potential markets and clients? “It’s important that reps. know everything you can do. We are lucky in that we can devote some of our sales reps. to certain sectors, such as education, but we also send out newsletters every 10-12 weeks and sometimes we’ll do a mailshot or put something on YouTube to build brand awareness – that’s the key. Sometimes you have to buy in a list for a sector that you don’t know well – and we’ll do an e-shot to them. That way you can at least see who’s opening the mailer and responded etc. so you can monitor progress. Even if you don’t get an immediate sale they might stick

you in their favourites,” said Judge. McKenzie and Williams too proved an exponent of e-shots and building brand awareness via the internet, but not everyone was convinced of its value in developing markets. “Face-to-face is the only way as we see it. We have open days for agencies and make sure they know about everything we can do,” said Holland. “We do a lot of work with agencies too because designers love all the creative stuff you can throw at them,” added Marsh. Stringwell also takes the direct approach: “We identify clients for specific new products and actually go to show them samples.”

Investment

There certainly must be enough work from somewhere to be prompting capital investment. This spring 75% of the respondents to the Widthwise survey said they expected to invest in WF kit by spring 2011, with 31% of those spending more that £50,000. If the Round Table was anything to go by these are conservative figures, with only one of the seven not having already bought new kit in 2009 and all but Williams saying they would be investing further over the next 12 months (and even Williams says he’ll probably trade-in a piece of older kit for a new dye-sub printer).

“The problem is that though we all need to keep investing, whether it be for extra capacity, to build on new niches, or just get a better quality unit, we find ourselves buying machines that have no real resale value,” pointed out McKenzie.

“That means some funders won’t touch printing equipment any more,” added Wilson. “Plus if you are buying a higher price piece of kit you’re expected to give director’s guarantee and after three years it’s not worth anything really.”

The issue of funding and resale values aside, the fact that so much investment is continuing to take place made for an optimistic mood. Latex ink printers, flatbeds and clever cutters all came in for praise and were highlighted as items on the ‘must-have’ lists of those around the table.

Technology

But what were the technology niggles – those areas where the panellists want to see suppliers devote more R&D? In the Widthwise survey kit reliability and running costs came out top as to which criteria has the most impact on equipment purchasing. Cutting machine running costs and improving machine/materials reliability/consistency came out top of the R&D wish list. Would you be surprised to learn that at the Round Table ‘speed’ was still the first issue to be raised?

“Although our new printer is everything we wanted it to be and more, we know that two years down the line speed will be an issue,” said Stringwell. “We understand that something will appear that will make that the case, so even in the £150,000+ price bracket this is still something we have to be prepared for.”

Many of the other participants agreed with the comment to a larger or lesser degree, but running costs and efficiencies, green credentials, and workflow all raised their heads. “I think it’s important that manufacturers look at ways of making kit cheaper to run – we’ve seen ink prices shoot through the roof,” said Marsh. “But I think more R&D spend should also go in developing more environmentally friendly substrates that run well and consistently on the printer. The push of the market will mean machines automatically get faster and produce better quality.”

“Better workflow systems” were called for by Williams, “something that can make the whole Mac/PC/Rip set-up work in a more interactive and streamlined manner.”

“And job scheduling and its flow around the kit set-up could also do with some R&D input,” added McKenzie. “Printhead life and cleaning was an area earmarked by Holland. “If someone can come up with a better way of cleaning the heads other than purging them it would be great. It wastes a lot of ink and sometimes I feel like I’m buying the machine twice.” It was hardly surprising that the issue of service contracts came to the fore in this section of the debate, with plenty of discussion about cost and expectations.

“We shouldn’t have to pay a big monthly fee just to be confident our machines will keep running. It’s like there’s an inbuilt breakdown time set so that you have no option but to take out these costly contracts,” said Judge to much head nodding and general agreement.

“And I’d like to see the R&D to be done and the bugs ironed out before manufacturers start selling the kit,” added Wilson. “You shouldn’t have to be getting software upgrades etc. just weeks after a piece of kit has come to market.”

Asked what would be their main message to suppliers the panel’s overriding message was: to be more loyal and upfront with their customers. Greenwashing, the difficulty in getting hold of reps. postsales and being sent engineers who aren’t fully trained on the kit they’re repairing were contentious issues that the panel felt suppliers should do something about, but financial concerns topped the bill.

“We have to learn to be as hard on our suppliers as our customers are on us,” said Judge. “We need to start saying we want this discount or that rebate and we’ll pay you in xx amount of days if you want our business.”

“Yes, printers get driven through the floor on credit terms and suppliers don’t care – they have no sympathy for your situation when it comes to payment terms. Consumables people in particular will just put an order on stop if you have a cashflow problem one month and can’t pay – even though you could pay them a week later. I’ve seen suppliers start the rumour mill running about printers being in trouble when it’s just a case of a short-term cashflow – that then panics staff and it’s a rocky road from there,” added Wilson.

“We now ask for a three–year warranty on any machine as a condition of sale. We find out in advance what that warranty would cost, half it and make it part of the deal,’ continued Marsh.

Business management

Turning the spotlight back on the PSPs themselves, panellists were asked what they thought of the management skills within the sector. The overriding response was that if you are still in business you must be doing something right! “I think you’re either a good manager or not – it’s not down to management training. A lot of firms had managers which, when the market was more buoyant, made their money and had had enough by the time the economic and business landscape changed. They had a good lifestyle and weren’t interested in making all the changed necessary to move on. We’re the next generation,” enthused Wilson. “It’s all about communication,” added Judge. “As managers we need to be constantly explaining to staff what we’re about and making sure the message filters down effectively.”

There was general acknowledgement that there must be a two-way dialogue between management and staff on all issues – and that incentivising has a real role to play. “I think we’re probably our own biggest critics, which makes us reasonably good at what we do,” summed up Marsh. Image Reports will be conducting its third annual Widthwise survey in the new year.

If there are specific topics/issues you would like to see included please contact the editor Lesley Simpson. Email: Lesley.Simpson@imagereportsmag.co.uk

HOPES AND FEARS FOR 2010

Graham Clark

Hope: We’re forecasting double-digit growth in 2010. Fear: That the recession has not yet touched the normal person in the street and that post General Election we’ll see taxes rise.

Nick Holland

Hope: 2009 was good for making us look very closely at how we do business and we’ve tightened our belts. We’re now ready to make investment because there is growth out there. Fear: We’ll make investments that won’t pay for themselves.

Brian Judge

Hope: We’ve looked at overheads and margins, got rid of the deadwood and non-contributors and embraced different methods so we think we’re ready for 2010. Fear: Have we just been lucky so far?

Darren Marsh

Hope: We’ve reduced our debt level a lot and expect profit will be up 10% next year. There will be lots of scope in environmental areas. Fear: No real fears. 2010 will be better than 2009.

Chris Stringwell

Hope: I’m really optimistic for 2010. We’ve got one or two ideas outside the box that we’re hoping will come to fruition. Fear: That the General Election will affect spending.

Andy Williams

Hope: We really expect to grow in 2010 and we’re spending money on new sales staff. People have become more receptive to hearing new people come in and speak to them so we’re going to strike while that’s the case. Fear: That we won’t be prepared for environmental legislation.

Andy Wilson

Hope: That my expectations are wrong and fears misplaced. Fear: I’m expecting a slow start to the year and think we’ll see another recessionary dip that will really hit us.

{jathumbnail off}